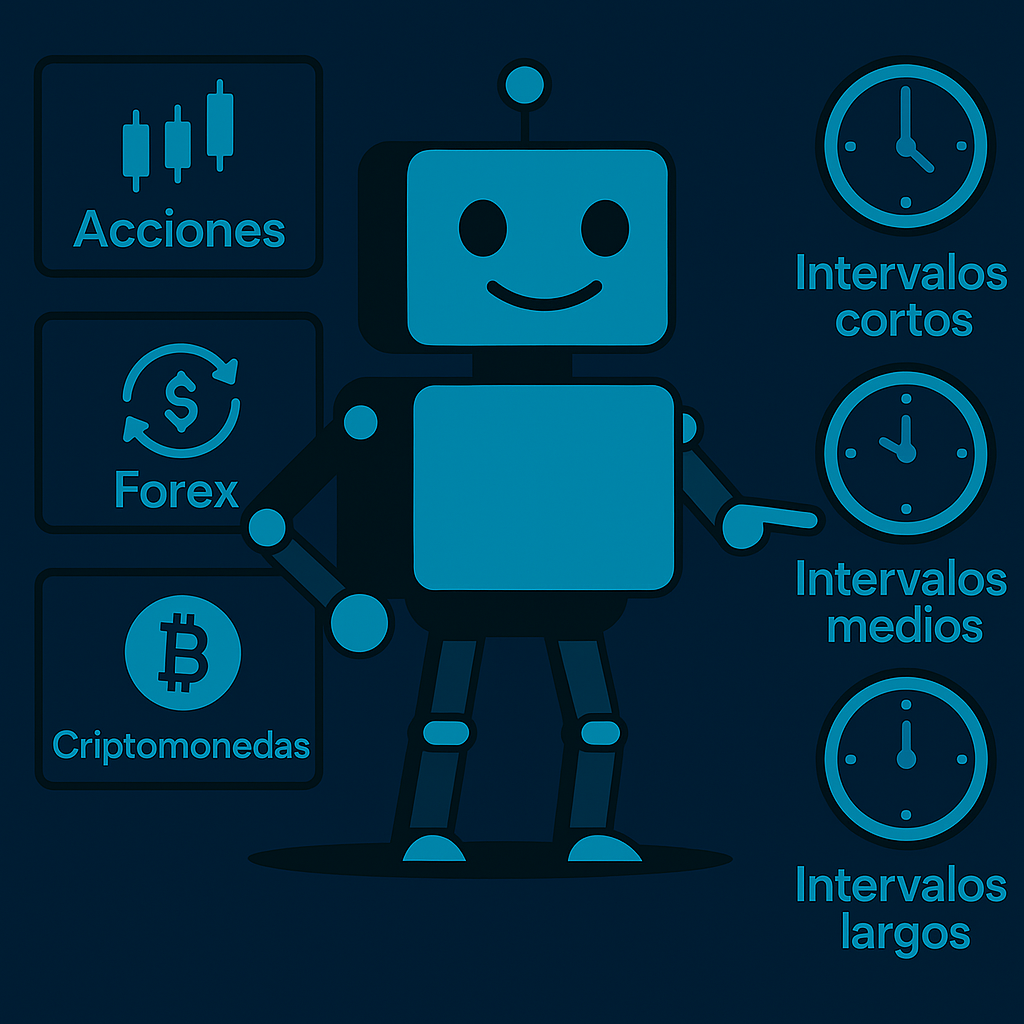

Automated trading systems allow strategies to be executed without human intervention, making trading more agile and precise. However, not all strategies work the same on all assets or time frames. Therefore, adjusting your robot according to the asset type and trading timeframe is key to improving its performance.

In this article, we explore how to adapt your system to better respond to different market conditions and become more efficient.

Each asset has its own rhythm

Different market assets behave differently. If your robot doesn’t take these particularities into account, it’s likely to fail.

Stocks: These tend to have lower volatility and are influenced by fundamental factors. To trade stocks, robots can use soft technical indicators and supplement them with fundamental data, such as news or financial results.

Forex: The foreign exchange market is fast-paced and volatile. Robots here must be agile and operate accurately. It’s advisable to configure them to make quick decisions and take advantage of short moves, using entry and exit strategies optimized for short time frames.

Cryptocurrencies: Volatility in this market is even greater. Therefore, robots must be highly adaptable and have solid risk management skills. Working with dynamic time frames and being ready to react to sudden changes is essential.

Adjustments according to the time frame

The timeframe you use completely changes the robot’s approach. Here’s how to adapt your strategy to each timeframe:

- Short timeframes (1-5 minutes): Ideal for scalping. The robot should react quickly to small changes. Indicators such as RSI, moving averages, or candlestick patterns should be configured sensitively to detect short movements.

- Medium-range (15 minutes to 1 hour): Swing trading or trend-following can be used here. The robot can act more calmly and rely on tools like the MACD or Bollinger Bands to define entries and exits.

- Long-term timeframes (daily or weekly): These are useful for more stable strategies based on long-term analysis. The robot should focus on broad movements, using indicators such as the ADX or an RSI adjusted to longer periods.

Optimization and testing: key points before going live

Before activating your robot, it’s essential to thoroughly test it. Two key steps:

- Backtesting: Evaluate your strategy with historical data, across different assets and timeframes. This way, you can see how it would have performed and adjust details such as trade size, entry frequency, indicators, and risk management.

- Optimization: This is the process of adjusting the robot’s parameters to make it perform better. But be careful: it’s not just about improving past results, but also preparing the robot for different future scenarios. If an asset becomes more volatile, the robot should be able to adapt.

The importance of managing risk

A good strategy can fail if risk isn’t properly managed. Therefore, your robot must have clear rules to protect your capital:

- Automatic stop loss and take profit: These levels should be adjusted to market conditions. It’s also useful to have a trailing stop, which allows you to lock in profits while letting the trade run.

- Dynamic Position Sizing: The robot should be able to adjust the traded amount based on asset volatility and account size.

Flexibility and adaptability

Even if a robot operates autonomously, it needs to be flexible. Markets are constantly changing, and your system must be able to adapt:

- Automatic adjustments: Some systems allow you to change your strategy depending on the context: more conservative in lateral ranges, more aggressive in clear trends, for example.

- Algorithm Updates: It’s key to keep the robot up-to-date. You can even incorporate machine learning so the system improves with experience.

Conclusion

Tuning a trading robot to the asset and timeframe is one of the keys to improving its performance. Understanding the characteristics of each instrument, adapting the robot’s logic to the correct timeframe, rigorously testing it, and having a well-structured risk management system will make all the difference.

Furthermore, the more flexible and adaptable your system is, the better prepared it will be to operate in constantly changing markets. In today’s dynamic environment, this ability to evolve is what makes an automated robot a truly effective tool.

Articles that might be helpful: